How to take loan in 5 minutes : Friends, in today’s article, we will talk about how you will get a loan in 5 minutes. Friends, if you want to take a loan in 5 minutes, then read this article carefully and follow this article. Friends, in today’s inflationary era, everyone needs a loan. Sometimes there is such a dire need that we are forced to take a loan immediately, in such a situation, if we apply for a loan by going to the bank, then the process and procedure is very long there, but now you can do the following in just 5 minutes. You can get an instant personal loan using the methods mentioned above. In today’s article, we will talk about how to take a loan in 5 minutes, what are the 7 ways to take a loan in 5 minutes, benefits of taking a loan in 5 minutes, eligibility to take a loan in 5 minutes, taking a loan in 5 minutes What are the documents required for etc. You will get all the information in today’s article.

7 Ways to Get a 5 Minute Me Loan

Friends, if you want to get a loan in 5 minutes, then you can use the loan application from Google Play Store, by registering there, you can get an instant personal loan with a faster process. Apart from this, you can use Bank and NBFC company to take loan. But today we will talk about how to get loan in 5 minutes through loan application.

| Sr. No. | App Name |

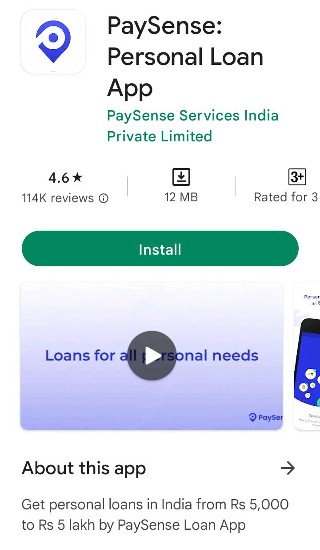

| 1. | Pay Sense |

| 2. | Money view |

| 3. | क्रेडिटबी |

| 4. | CASHe |

| 5. | स्मार्टकॉइन |

| 6. | Fibe |

| 7. | BharatPe |

How to take loan from PaySense in 5 minutes?

Friends, if you have a loan from PaySense App and you are facing any problem in taking the loan, then follow the steps given below –

1 – First of all you have to download PaySense App from Google Play Store.

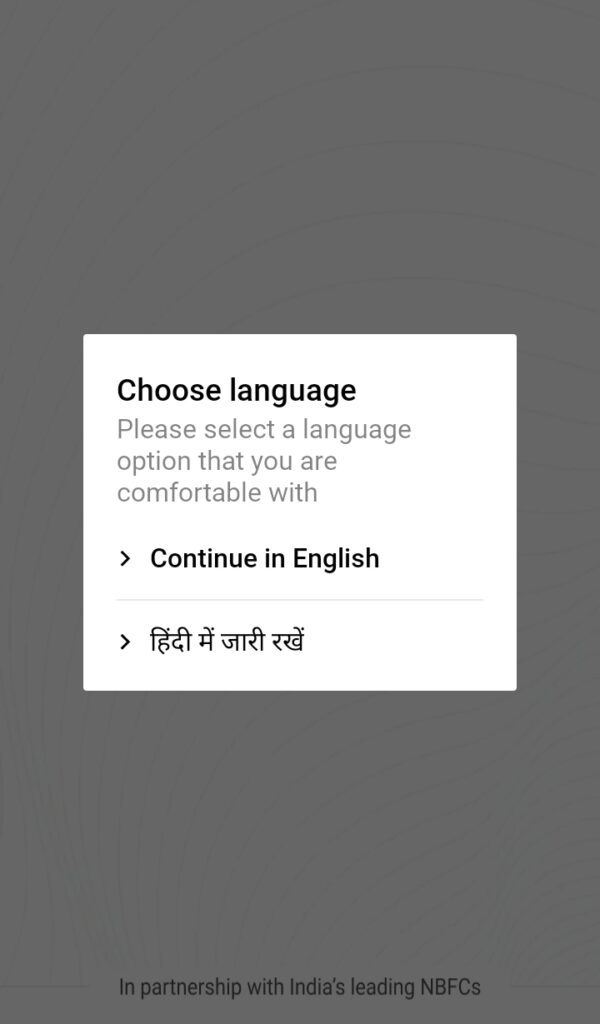

2 – After this, you have to select your language and click on the option of Get Started.

3 – Next PaySense App asks for some of your permissions, you have to allow it.

4 – Next you have to click on Create Your Account option.

5 – After this you have to fill your basic information like –

- Your name

- last name

- your date of birth

- gender

- mobile number

- Email Id

- Employment Type

- PAN number

- Your Address

After filling all these details, you have to click on the Save and Continue option.

6 – After this an OTP will come on the mobile number you have entered, you have to fill the OTP.

7 – Next you have to complete KYC by filling important documents like Aadhaar Card, PAN Card and Bank Account Detail.

8 – After completing KYC, the loan amount is transferred to your bank account.

How to take loan from Moneyview in 5 minutes?

- Step 1. Friends, first of all download this app from Google or Play Store app.

- Step 2. After opening the app, you have to select your language and click on Okey next.

- Step 3. Next asks you for some permission, allow it. And click on the Start option.

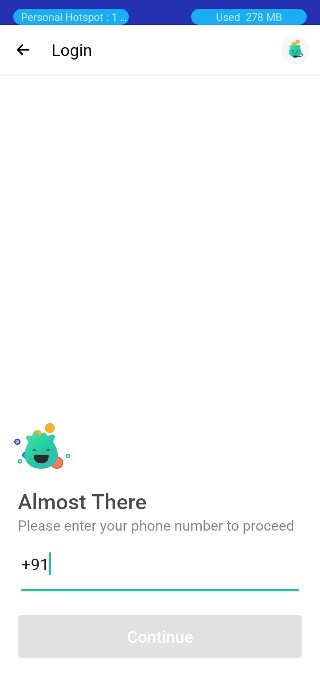

- Step 4. Next you sign up with your mobile number and click on the option of Continue.

- Step 5. Next you have to click on the Apply Loan button.

- Step 6. Now you have to fill your basic details.

- Step 7. After this you have to choose the loan amount according to your income and after that you have to click on continue to apply.

- Step 8. After this you have to upload photo of PAN card, one of your selfie and address proof. After this you have to click on Next.

- Step 9. Now you will get a Verification Call and they ask you some basic information.

- Step 10. In this way the loan amount will be easily transferred to your bank account.

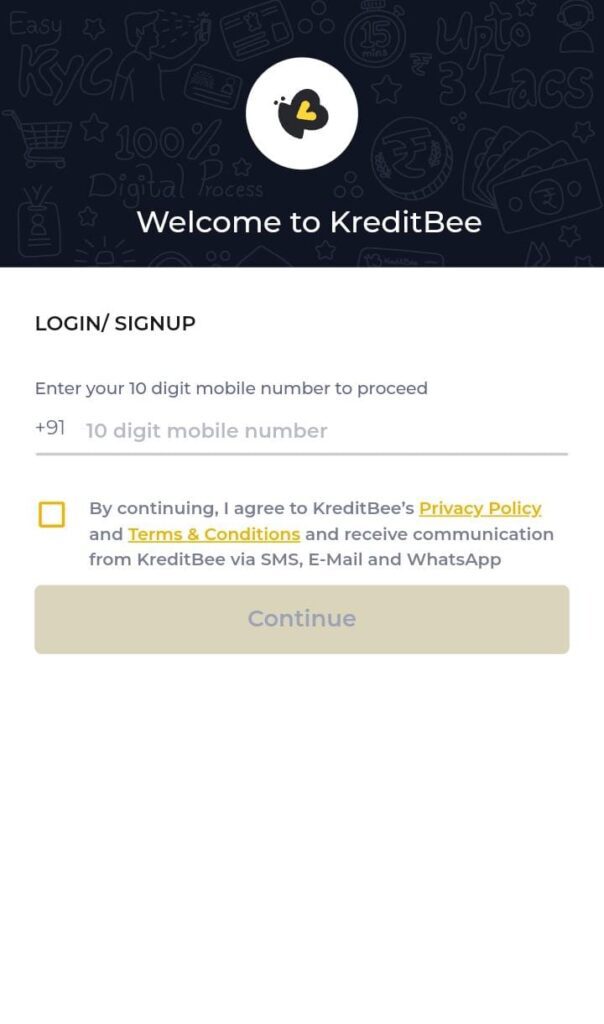

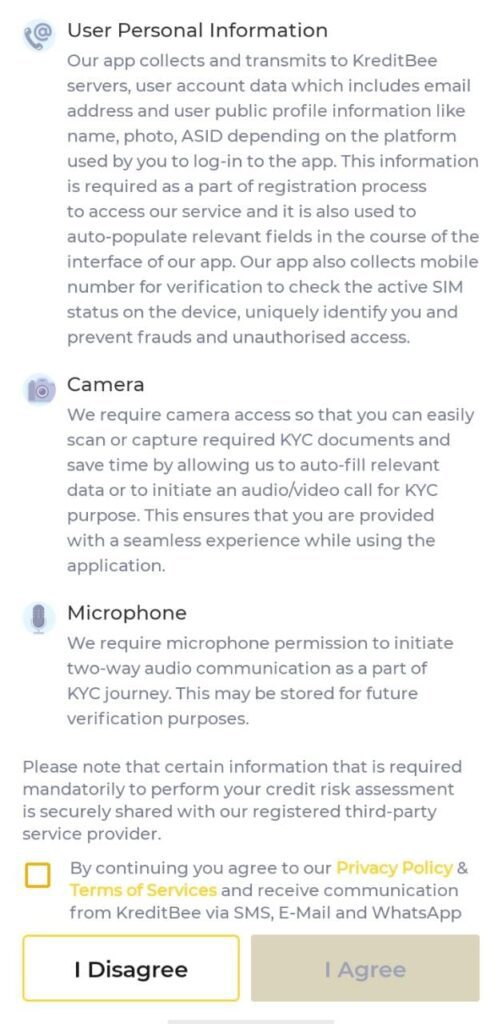

Howto take loan from KreditBee in 5 minutes?

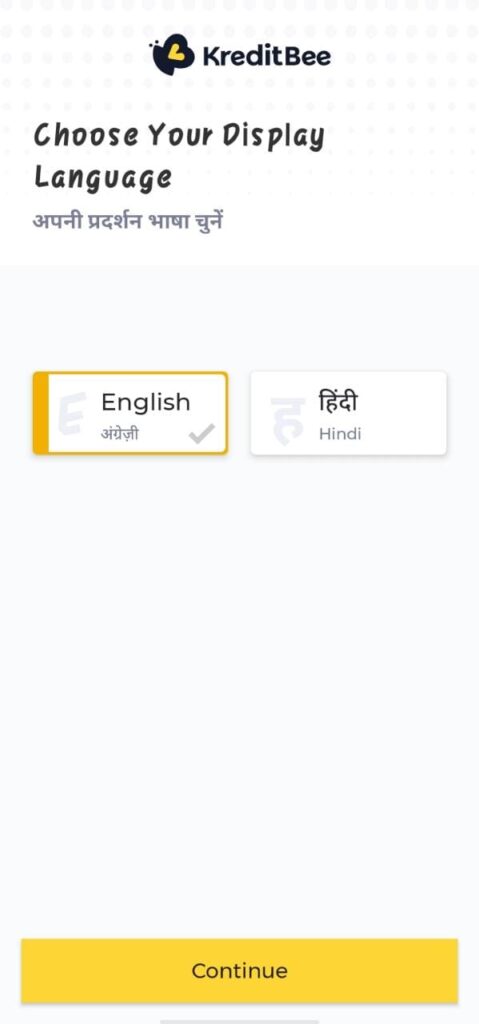

- Step 1. First download KreditBee App from Play Store and install it on your mobile.

- Step 2. After this, after selecting the language, click on the option of Continue, and then click on the option of Get Started.

Step 3. After this sign up with mobile number and click on the option of Continue.

Step 3. After this sign up with mobile number and click on the option of Continue. Step 4. After this an OTP will come on your mobile number. Fill the OTP and click on the Submit option.

Step 4. After this an OTP will come on your mobile number. Fill the OTP and click on the Submit option.- Step 5. Next, by accepting the terms and conditions of KreditBee, click on the I Agree option.

Step 6. Allow whatever permission KreditBee asks you to access.

Step 6. Allow whatever permission KreditBee asks you to access.- Step 7. After this you enter your email and click on the option of Continue.

- Step 8. Now you have to come to KreditBee’s homepage.

- Step 9. Now by clicking on the Check Eligibility option, first check whether you are eligible to take a loan from KreditBee or not.

- Step 10. If you are eligible to take a loan on KreditBee App, fill all the details KreditBee asks from you and also attach your documents, now the loan will be transferred to your bank account in no time. Will go

How to take loan from CASHe?

- Step 1 – First of all you have to download CASHe App from your Play Store.

- Step 2 – After this you have to open the CASHe App, and the App asks for some Permission from you, Allow them.

- Step 3 – Now you have to log in with your Google account on the cashe app.

- Step 4 – After this you have to accept the term and condition of this app.

- Step 5 – After this you will see the option of Get Loan, click on it.

- Step 6 – After this you have to fill your Personal Information.

- Step 7 – After this you have to fill your Contact Information.

- Step 8 – After this you have to fill your Work Information.

- Step 9 – After this you have to fill the information of your bank, you have to fill your bank account number and IFSC code correctly.

- Step 10 – After filling all this information, if you are eligible for the loan, then the loan amount will be told to you.

- Step 11 – Next you have to click on Borrow Now and the loan amount will be credited to your account in no time.

How to take loan from SmartCoin in 5 minutes?

1 – First of all you have to download SmartCoin – Personal Loan App from Google Play Store.

2 – After this, you have to select your language and click on the option of Get Started.

3 – Next SmartCoin App asks for some of your permissions, you have to allow it.

4 – Next you have to click on Create Your Account option.

5 – After this you have to fill your basic information like –

- Your name

- last name

- your date of birth

- gender

- mobile number

- Email ID

- Employment Type

- PAN Number

- Your Address

After filling all these details, you have to click on the Save and Continue option.

6 – After this an OTP will come on the mobile number you have entered, you have to fill the OTP.

7 – Next you have to complete KYC by filling important documents like Aadhaar Card, PAN Card and Bank Account Detail.

8 – After completing KYC, the loan amount is transferred to your bank account.

How to take loan from Fibe App in 5 minutes?

- Step 1. First of all, install the Fibe Loan Application on your smart phone.

- Step 2. After this you open this app and further asks you for some permissions, all have to be allowed.

- Step 3. After this you have to enter your mobile number and then click on Next.

- Step 4. Now next you have to go to the homepage and click on CASH Loan.

- Step 5. After clicking, here you have to fill your personal details, address etc., and then click on Proceed.

- Step 6. After this you have to upload your Bank Statement.

- Step 7. Now to upload your bank statement, fill the bank account and then by entering your customer ID and user ID, you have to verify with OTP.

- Step 8. Complete your online eKYC to get the loan amount in your bank account.

- Step 9. After this you have to verify by entering your Aadhaar card number and OTP and then click on Next.

- Step 10. After this you have to connect your bank account with auto nache, where you have to link your debit card or internet banking.

- Step 11. After this your loan goes to review, you have to wait for about 15 minutes.

- Step 12. After some time the loan amount will be transferred to your own bank account.

How to take loan from BharatPe in 5 minutes?

1 – First of all you have to download BharatPe from Google Play Store.

2 – After this, you have to select your language and click on the option of Get Started.

3 – Next PaySense App asks for some of your permissions, you have to allow it.

4 – Next you have to click on Create Your Account option.

5 – After this you have to fill your basic information like –

- Your name

- last name

- your date of birth

- gender

- mobile number

- Email ID

- Employment Type

- PAN Number

- Your Address

After filling all these details, you have to click on the Save and Continue option.

6 – After this an OTP will come on the mobile number you have entered, you have to fill the OTP.

7 – Next you have to complete KYC by filling important documents like Aadhaar Card, PAN Card and Bank Account Detail.

8 – After completing KYC, the loan amount is transferred to your bank account.

इसे भी पढ़े – In Hindi

5 मिनट में लोन लेने के 5 तरीके || न्यू अप्प से लोन कैसे ले ?

मोबाइल से लोन कैसे ले ? जानें ब्याज दरें, ज़रूरी दस्तावेज और कैसे अप्लाई करे ?

लोन अप्प से लोन कैसे ले ? जानें ब्याज दरें, ज़रूरी दस्तावेज और कैसे अप्लाई करे ?

I Need 5000 Rupees Loan Urgently || 5000 रूपये का तुरंत लोन कैसे ले

Personal Loan : ब्याज दरें , योग्यताएं और लोन कैसे अप्लाई करे ?

What are the benefits of taking 5 Minute Me Loan?

- You can avail this personal loan in a few minutes over the phone.

- The biggest advantage is that in case of sudden need, you can take a loan in 5 minutes, only by doing KYC, this loan is available without guarantee and security.

- This personal loan is 100% digital online.

- Your CIBIL increases with the payment, due to which you can easily get a loan from anywhere.

- You can avail this personal loan without any physical verification.

- This loan is available on top of your bank statement without income proof.

- You can apply for 5 Minute me loan again immediately after making the payment.

- This loan is completely approved by RBI.

What is the eligibility for taking 5 Minute Me Loan?

1. You can take personal loan from this application only if you work in a company or have a government job.

2. If you live in Delhi or Mumbai, then your monthly income should be at least 20 thousand rupees per month.

3. You must be at least 21 years old if you apply for the loan.

4. Pay through Direct Bank Transfer only.

5. You must be an Indian citizen.

6. You must have KYC documents.

7. It is necessary to have a smart phone to apply for the loan.

8. If you live in any other city except Delhi and Mumbai, then your monthly income should be 18 thousand rupees per month.

Read this also – KreditParty App: Interest rates, eligibility and how to apply loan?

Documents required for 5 Minute Me Loan

If you take a loan, then the following documents are required –

1. A photo of you is required.

2. It is very important to have a PAN card.

3. You must have ID Proof (Any 1 – Driving License/Voter ID/Passport/Aadhar Card)

4. You must have Address Proof (Any 1 – Driving License/Voter ID/Passport/Aadhar Card/Utility Bill)

5. Must have 3 months bank statement with salary credit.

6. Aadhaar Card (Optional)

[…] […]