How to take loan from CrediFyn app :- Friends, our life is changeable, sometimes financial problems come in everyone’s life, whenever there is a sudden need of money, we get upset. Because we are not prepared in advance for sudden problems. In such a situation, we want to get money immediately and get upset because the bank loan process is long, boring, troublesome and time consuming, so we call friends for urgent loans, but friends are also not helpful every time when we need money immediately. In such a situation, we need to take a personal loan.

Now when all the other ways are closed, nowadays one more way has opened, that is Urgent App Loan i.e. you can take instant loan sitting at home through mobile app. We recommend that you choose this route only when you are in a lot of trouble and there is no other way because personal loans are a bit expensive and also for a short period of time, all other loan applications offer different plans.

But friends, today we are talking about CrediFyn App Se Loan Kaise Le, with this you can take loan from 1 thousand rupees to 2 lakh rupees. Which can take from a few minutes to a few hours. This loan is available for a maximum period of 24 months. The tenure of the CrediFyn Loan App varies according to the loan amount. Availing a loan with the CrediFyn Loan App is simple and easy and also saves your time.

What is CrediFyn Loan App?

CrediFyn – formerly known as Money in Minutes, is an online lending platform with over 1 million downloads that offers personal loans up to ₹2 Lakh. All loans were disbursed by Unique Auto Finance & Leasing Private Limited, an RBI registered NBFC.

How to take loan from CrediFyn app? (Step By Step)

- Step 1 – First of all you have to download CrediFyn Loan App from your Play Store.

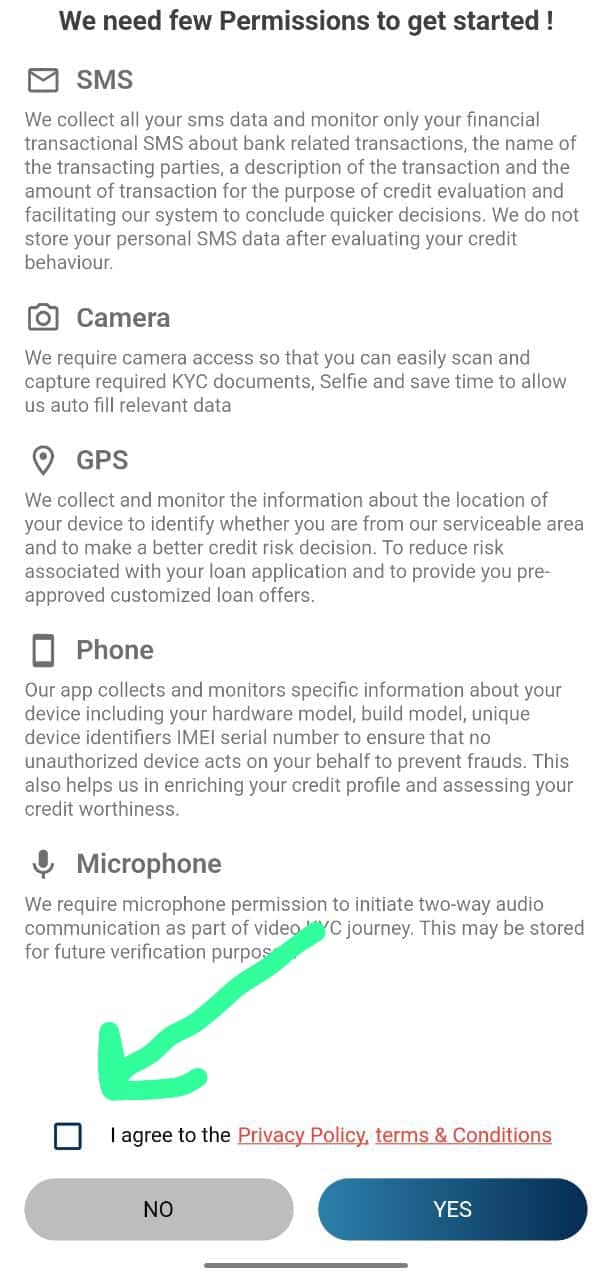

- Step 2 – After this you have to open the CrediFyn App, and the App asks for some Permission from you, allow them.

- Step 3 – After this you have to click on the Next button. And move on.

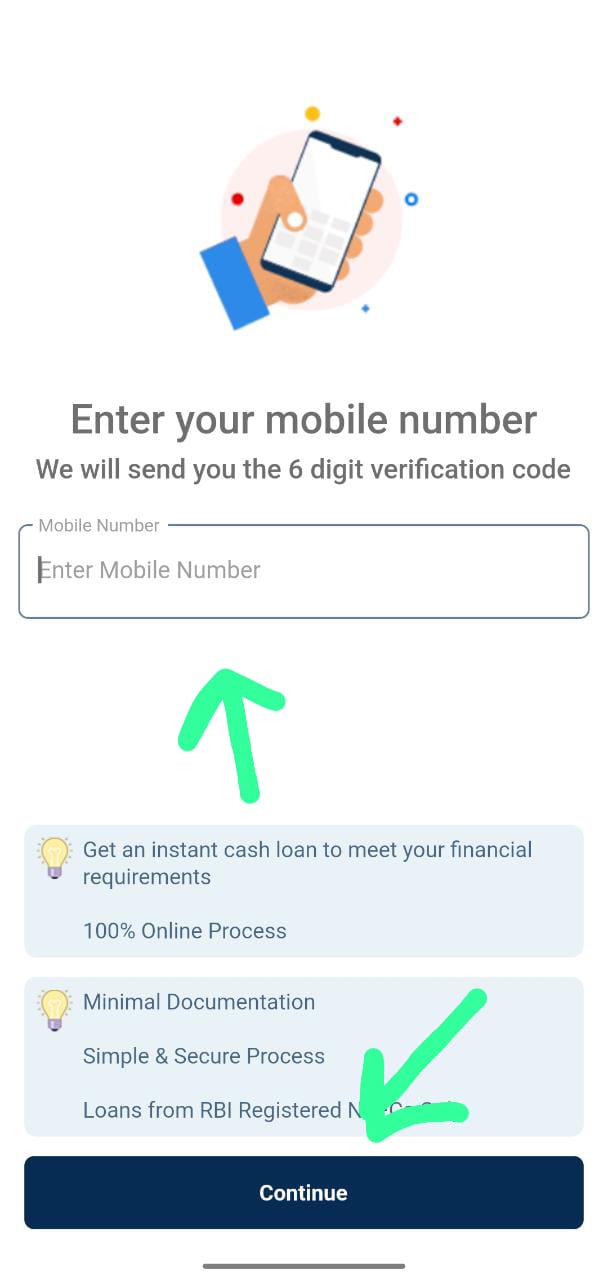

- Step 4 – After this you have to enter your mobile number and click on the Continue option.

- Step 5 – After this you will get a code on mobile. Feel that code.

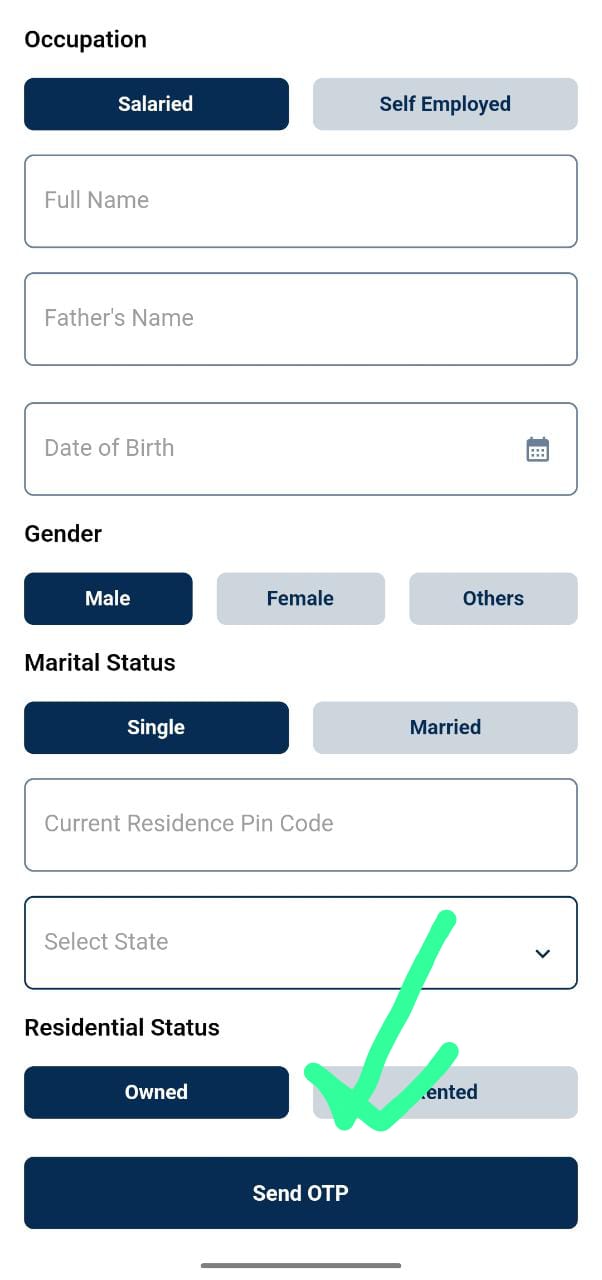

- Step 6 – Next you have to fill some of your personal information like –

- Occupation

- Your name

- father’s name

- your date of birth

- gender

- Marital Status

- pin code of your area

- Which is your state?

- Step 7 – After clicking on all the information, click on Send OTP.

- Step 8 – Next you have to click on Apply Now for the loan.

- Step 9 – Next you have to click on the option containing KYC Document.

- Step 10 – After this you have to fill your Personal Information.

- Step 11 – After this you have to fill your Contact Information.

- Step 12 – After this you have to fill your Work Information.

- Step 13 – After this you have to fill the information of your bank, you have to fill your bank account number and IFSC code correctly.

- Step 14 – After filling all this information, if you are eligible for the loan, then the loan amount will be told to you.

- Step 15 – Next you have to click on Borrow Now and the loan amount will be credited to your account in no time.

How is CrediFyn better than others?

- Credit Check: We approve your personal loan applications regardless of your credit score as this is not the only parameter we look at before approving you.

- Quick Approval & Disbursement: We approve your loan application within minutes based on the information and documents provided by you.

- Money Transfer: We transfer money directly to your bank account.

- Easy Application Process: Apply online through our app, just fill the form and submit.

- Flexible interest rates: Various interest rates starting from 0.15% to 0.05% per day.

What are the types of loans offered by CrediFyn app?

Types of loans you can apply for:

- Instant Personal Loan

- Quick loan or Quick loan

- Emergency loan or Urgent loan

- installment loan

- Same Day Loan

- Secured Loan

What are the features of CrediFyn App?

Key Features of the Credifin Personal Loan App:

- Quick and easy loan approval

- 100 percent online loan process

- With the help of this app, you can take loan sitting at home.

- The loan amount comes directly to your bank account.

- 100% paperless work is done.

- Minimum documentation is required.

- Loan approval is available in 11 minutes.

- Provides 24*7 online support to individuals.

- Benefits and Risks of the CrediFyn App

- Users can get access to higher loan amount and tenure by paying as per the repayment schedule.

- The repayment behavior is shared with all credit rating agencies as per the directions of the Reserve Bank of India.

Interest rates for availing loan through CrediFyn app

Friends, the interest rates for taking loan from CrediFyn app start from 21.5% to 69% per annum. The final interest rates offered to applicants depend on age, monthly income, job profile, credit score, loan repayment record, etc.

- Minimum interest rate – 21.5% per annum

- Maximum interest rate – 69% per annum

Eligibility Criteria for availing loan from CrediFyn App

Friends, to take a loan from CrediFyn app, one has to fulfill the following eligibility conditions:-

- Indian Citizen Age: 21 to 65 years

- Minimum Income: Annual income above 2 lakhs for both employed and non-employed applicants

- CIBIL score should be more than 650.

Documents required for availing loan from CrediFyn app

- PAN card

- Aadhar card

- Selfie of the applicant as proof.

Read this also –

How to get Loan Without Documents?

How to take loan from 10000 to 50000?

About CrediFyn App

CrediFyn offers instant loans from ₹ 1,000 to ₹ 2,00,000.

Minimum Repayment Tenure: 62 days.

Maximum Repayment Tenure: 730 days (24 months).

Maximum Annual Percentage Rate (APR): 21.5% to 69% depending on the risk profile of the customer and the product availed.

Platform on boarding fee (one time): ₹350 (excluding GST).

Processing Fee: 3% to 15% of the loan amount. (Except GST).

CrediFyn App Loan Customer Care

If you encounter any problems, don’t hesitate to contact us.

- E-mail ID: [email protected]

- Website: https://credifyn.com/

- Address: JE-6, Office No.-3, Beri Wala Bagh, Hari Nagar, New Delhi -110064.

- Application: CrediFyn App

Read this also – In Hindi

10000 से 50000 तक का लोन कैसे ले ?

I Need 5000 Rupees Loan Urgently

Personal Loan : ब्याज दरें , योग्यताएं और लोन कैसे अप्लाई करे ?

Questions related to CrediFyn App

Q1. Who can avail loan from CrediFyn App?

ANS. Friends, loan amount is provided to employed (working in private limited company or public sector undertaking) and non-employed individuals with at least 1 year of work experience for loans up to Rs.2 lakh.

Q2. CrediFyn application is fake or genuine?

ANS. Friends CrediFyn App is a legitimate application that provides loan and health insurance services. You can avail the instant loan facility in case of an emergency or in times like these.

Q3. What is the loan interest rate on CrediFyn?

ANS. Starts from 21.5% p.a.

Q4. What is the tenure of the loan on CrediFyn App?

ANS. 2 Years