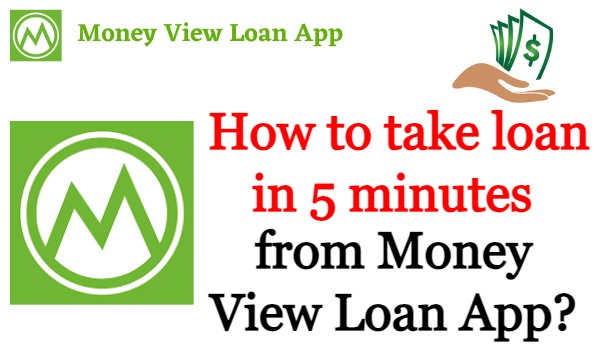

How to take a loan in 5 minutes from Money View Loan App – Friends, in today’s article, we will talk about how you can get a loan sitting at home in 5 minutes with the help of online app. Friends, India is the most populous country in the world where most of the people belong to middle class family. In such a situation, to meet some of your essential needs, sometimes you take a loan from a friend or relative.

If for some reason friends or relatives refuse to give loan, then you feel very disappointed at that time. To remove the same disappointment, today we have brought a loan application for you, with the help of which you can take a loan in 5 minutes, the name of that application is – Money View Loan App.

Friends, in today’s article we will talk about – What is Money View Loan App, How to take loan in 5 minutes from Money View Loan App, Documents required to take loan in 5 minutes from Money View Loan App, 5 from Money View Loan App What is the eligibility criteria for taking loan in minutes, how much loan will be available in 5 minutes from Money View Loan App, etc. all the information will be found in this article.

What is Money View Loan App?

Money View is an online personal loan NBFC company that provides loans up to Rs.5 lakh to people doing jobs and businesses through a completely digital and paperless process. Money View loan interest rates start from 1.33% per month. Personal loan applicants can check whether they are eligible for the loan within 2 minutes and the loan amount is transferred within 24 hours of loan application approval. From applying for the loan to transferring the amount, the process is completely digital. Money View also has its own credit scoring model so that applicants with low credit scores can also avail loans.

How to take loan in 5 minutes from Money View Loan App?

Friends, if you want to get a loan in 5 minutes, then you can use the loan application from Google Play Store, by registering there, you can get an instant personal loan with a faster process. Apart from this, you can use Bank and NBFC company to take loan. But today we will talk about how to take loan in 5 minutes from Money View Loan App? Below we have told you all step by step –

- Step 1: – First of all download and install Money View App on your smartphone through Play Store.

- Step 2: – After this, whatever permission will be asked from you by MoneyView, you have to allow it and select your language and click on the option of Get Start.

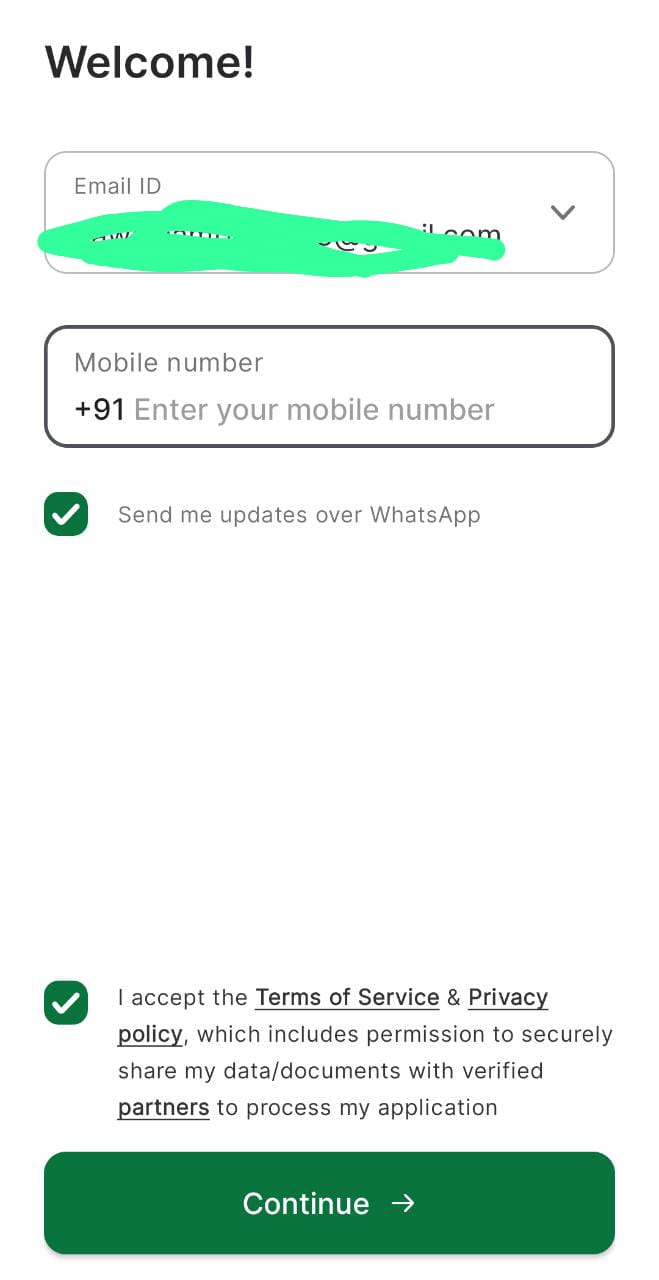

- Step 3: – Now create your account in this app with your Gmail ID, after which you will reach on the homepage of this app.

- Step 4: – In the next step, you have to click on the Get An Instant Loan option.

- Step 5: – Next you have to enter your name and phone number and click on the option of Send OTP SMS and get your mobile number verified by filling OTP.

- Step 6: – Now you have to fill all the necessary information asked to check the eligibility whether you are eligible to take Personal Loan or not.

- Step 7 :- If you get approved for the loan through Money View Loan App, then all the required documents have to be uploaded.

- Step 8: – As soon as you upload the documents and your documents are verified, the loan amount will be transferred to your bank account.

Documents required to take loan in 5 minutes from Money View Loan App

There are very few documents you need to submit while applying for Money View Personal Loan. The following documents need to be submitted for availing a Personal Loan from Money View:

For The Employed

1. Identity proof- It is necessary to submit PAN card under identity proof. But if it is rejected due to image quality or other reasons, then one of the following documents has to be submitted:

- Passport

- Aadhar card

- Voter ID Card

- Driver’s license

2. Address Proof

- Passport

- Aadhar card

- Voter ID Card

- driving license

- Utility bill (water, gas, electricity) paid within the last 60 days

3. Income Proof

- For salaried applicants – Last 3 months bank statement (in pdf format) showing credit of salary

- For non-employed applicants – Last 3 months bank statement (in PDF format)

What is the eligibility criteria to avail loan in 5 minutes from Money View Loan App?

1. Both salaried and non-salaried people can avail this loan

2. The age of the applicant should be between 21 to 57 years.

3. CIBIL Score at least 600 or Experian Score at least 650

4. You should get your salary in your bank account.

5. Minimum income (for employed)

- For Mumbai / Thane or NCR – 20,000

- For metro cities other than Mumbai and NCR – 15,000

- For other areas – Rs.13,500.

6. Minimum income (for non-employed – Rs. 15,000)

- The income should come directly into the bank account of the applicant. Those who get salary in cash cannot apply for this loan.

If you come under the Money View Loan Eligibility Criteria mentioned above, then you can easily get a loan through Money View.

How much loan is available in 5 minutes from Money View Loan App?

If you do not know about how much loan you can get from Money View in 5 minutes, then you would like to tell that normally a loan ranging from Rs 10000 to Rs 1 lakh can be obtained through Money View. But if you take a loan from Money View and repay the loan amount on time, then the next time you apply for a loan on this app, you can get a higher loan amount.

Read this also – How to take a loan of up to Rs 10 lakh in 10 minutes

How much interest is charged on loan in 5 minutes from Money View Loan App?

Money View Personal Loan interest rates start from 1.33% per month depending on the loan amount, credit score, income profile, business profile, employee profile etc. of the applicants.

How much processing fee and charges are applicable on loan in 5 minutes from Money View Loan App?

| Fees and Charges Rates | Rates |

| Loan processing fee | 2% – 8% of the sanctioned loan amount |

| Interest on outstanding EMI | @ 2% p.m. on outstanding principal/EMI |

| Check bounce | ₹ 500 per check bounce |

| Foreclosure Fee Nil | Nil |

| Loan Cancellation No Additional Fee | No Additional Fee |

| Part prepayment charges | Money View** As per personal loan agreement |

| Details | click more |

Money View Customer Care

You can use any of the following means to contact Money View customer care:

- By phone: You can call the company’s customer care number 080-4569-2002

- Loan Payment Queries : [email protected]

- Loan related queries : [email protected]

- General queries : [email protected]

Money View App Questions

Q1. Is MoneyView App Safe?

ANS. It is absolutely safe to avail loan from Money View App as this company is an RBI registered NBFC company.

Q2. Who is the owner of Money View Loan?

ANS. The owner of Money View Loan is Puneet Agarwal.

Q3. When was Money View Loan Company established?

ANS. Money View Loan Company was established in 2014.

[…] […]